The Macro

I recently finished reading Into Thin Air, Jon Krakuer’s famous novel on the 1996 Everest disaster.

I’ll spare you the details, but as we know, climbing Everest is incredibly difficult. A tremendous amount of people fail to summit the world’s tallest mountain, often resulting in death or a catastrophic injury.

In the book, Jon Krakauer points out that the average person views climbing mountains as just another adrenaline-seeking experience. In reality, there is nothing adrenaline-seeking about it -- the end goal is not a constant stream of euphoria while you trudge into the atmosphere.

Climbing a mountain sucks, and there’s really nothing fun about it. Climbing a mountain is less about thrills and more about proving that you can tolerate immense pain and hardship. It is about making it to the top despite the constant stream of challenges you’ll face. If you make it, you don’t arrive unscathed.

You probably see where I’m going with this, but the analogy of starting a startup is a lot like scaling a mountain, is true.

In the book, Jon Krakauer speaks of two truths about mountain climbing that I believe are directly applicable to the state of startups we’ve experienced and read about thus far in 2020.

Climbing might be the only sport in the world where you celebrate being 50% done.

Climb high enough, you will eventually find yourself in the death zone (death zone’s don’t exist on all mountains and the most famous one is on Everest)

So let’s talk about these lessons, for many startups the moment you file your IPO (or raise a massive private round of funding) in many ways makes you feel like you are top of the world. You survived the desperately long slow climb to the top and you’re about to be rich! Cue the confetti and click check-out on the Tesla pre-order because you have reached the summit.

However, as we have seen recently with the IPO’s of notable consumer driven brands such as Casper, Blue Apron, Uber, Lyft, the real challenge has just started (or cumulated in the case of Blue Apron) . The ability to sustain themselves through the death zone and to the summit of an IPO has taken it’s toll, and now they must continue fight for survival to summit again another day.

As founders and employees of startups, the victories should be celebrated. But we must keep perspective and remain mentally tough. We cannot assume we have made it when in reality, the biggest victories often bring with them the biggest challenges. A death zone, indeed.

The Micro

Last week, Birmingham based Fintech startup Immediate announced a 7-figure seed round, although the actual amount raised wasn’t disclosed. Immediate provides early access pay to employees that haven’t been paid yet at partner companies of their platform.

It’s an interesting concept and serves as an added benefit employers can provide their employees. Considering the fact that nearly 20% of American adults can’t pay their bills on time, Immediate could be life-changing for many.

But isn’t that pay-day lending? Good question and that is something currently being discussed by a multitude of state governments. It’s the same regulatory gray area we’ve seen companies like Uber, Bird, and Airbnb all operate in.

Despite the potential of regulatory pressure, it’s big business with a predictable revenue stream, guaranteed payback, and has the added benefit of helping employers keep their employees happy.

Takeaway

I’m interested to see how Immediate does, they have incredibly steep competition, especially from the current market leader, Earnin. Earnin has a little different model where users “tip” Earnin after accessing their early pay (usually 10% of the wages they receive).

Earnin is pulling in close to $8 million in revenue according to some estimates and has been downloaded close to 12 million times since 2015. They’ve raised over $190 million from likes of a16z and Spark Capital.

They’ll have to target large employers in order to gain the necessary transaction volume in businesses such as fast-food restaurants and brick and mortar retail.

It’s a big market, and big markets attract a ton of competition. If Immediate can grow fast enough in the Southeast, it may paint itself as a potential acquisition target for the likes of Earnin and competitor Even (who just partnered with Wal-Marts 1.4 million employees to provide early pay)

What to Read

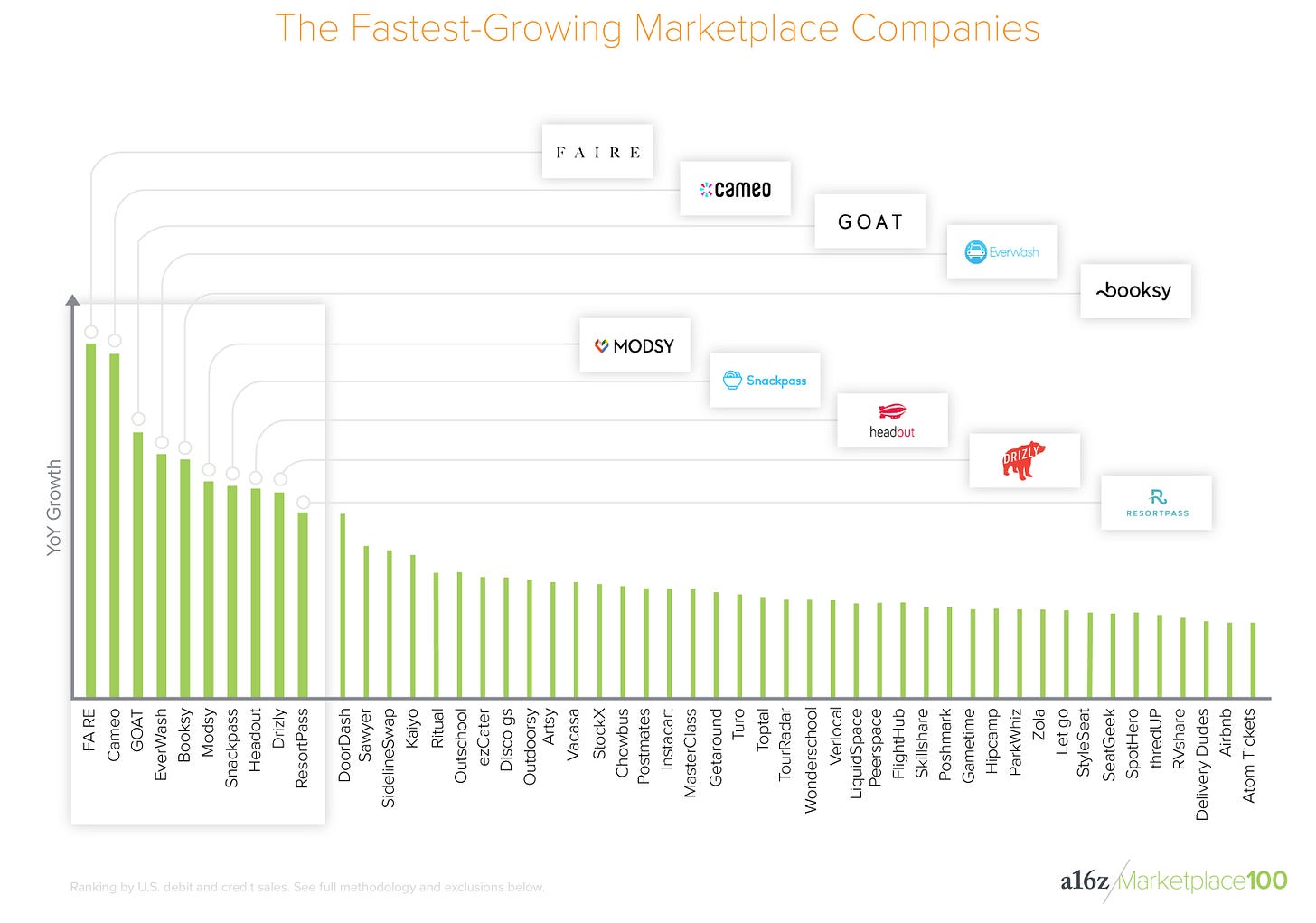

You have one assignment this week especially since the vast majority of my readers work at marketplace startups.

Check out a16z’s marketplace 100 to see which marketplaces in which categories are trending up or down.

Give it a read here

Happy Learning.

-Sean